Conversational AI is changing insurance customer service, claims, and sales. But insurance is not retail. It is emotional, regulated, and full of edge cases. That is why voice (not just chat) is becoming the "front door" for modern insurers and agencies.

This guide maps the best use cases, shows two end-to-end voice agent playbooks, and explains how to build with an open-source stack using Dograh AI plus tools like LiveKit, Pipecat, and Vocode.

What conversational AI in insurance is (and why voice matters)

Conversational AI in insurance means software that can talk with policyholders and prospects using natural language. It can answer questions, collect details, update systems, and route to humans when needed. Voice matters because insurance conversations are often messy, emotional, and interruption-heavy.

Simple definition: chatbots, voice bots, virtual assistants

Conversational AI in insurance is a broad umbrella. Here is the simple breakdown:

- Chatbots: Text-based assistants on web chat, apps, or WhatsApp/SMS. Good for quick lookups, links, and document sharing.

- Voice bots (voice agents): Phone-based assistants that listen and speak. Best when people are stressed, driving, injured, or just want to talk.

- Virtual assistants (multichannel): One "brain" across voice + chat + email. The goal is to keep context across channels, not reset every time.

- Agent-assist: AI that helps the human agent during calls. It summarizes, suggests next best actions, and checks compliance.

Where it fits in insurance operations:

- Service: policy questions, ID cards, changes, billing

- Claims: FNOL (First Notice of Loss) intake, triage, status updates, document checklists

- Sales: qualification, quote Q&A, appointment booking

- Agent assist: reduce errors and enforce scripts

A real pattern I see in the field: start with L1-L2 calls (repetitive) and grow into orchestration. That is where voice AI becomes a workflow engine, not a "talking FAQ".

Why insurance is too nuanced for forms and basic chatbots

Insurance is not one product. There are many products and many variations.

You have auto, home, renters, health, life, business, travel, and specialty lines. Then each one has subtypes, riders, endorsements, deductibles, waiting periods, and exclusions.

And it gets harder:

- The same coverage name can mean different things across carriers

- Premium changes are rarely "one simple reason"

- Claims depend on exclusions, sub-limits, and timeline details

- Real value is tested at claim time, sometimes years later

That is why forms and basic chatbots break. They assume a linear path.

Voice works better because it supports:

- Interruptions ("Wait, what if the driver was my cousin?")

- Clarifying questions without back-and-forth typing

- Guided explanations in plain language

- Empathy when the customer is in a high-stress moment

This matters because claim calls often come after accidents, illness, fire, or death. A calm voice agent can reduce panic, collect FNOL accurately, and set expectations right away.

Where value shows up: speed, trust at claim time, and 24/7 coverage

Value shows up when you measure outcomes, not demos.

Core benefits most teams target:

- 24/7 availability for support, FNOL, renewals, and billing

- Lower cost per interaction by handling L1-L2 volume

- Faster resolution by collecting details once and triggering workflows

Insurance-specific value:

- Empathy at claim time when stress is highest

- Faster FNOL so cycle time starts earlier

- Consistent disclosures and logged consent in regulated scripts

- Less repetition across channels when systems are connected

One study of 15,000 customer interactions found 89.2% of consumers were frustrated when they had to repeat information across service channels, and this correlated with a 34% increase in churn for organizations with disconnected systems (IJFMR, 2024). Voice + tool integrations reduce the "repeat your story" problem.

Also, consumer adoption is not hypothetical anymore. A 2025 U.S. consumer study reported 56% are comfortable using automated voice systems for routine insurance questions, 58% are willing to trial AI-powered systems, and 48% said policy details are an ideal use case (Telnyx, 2025). That is selective readiness: start with routine calls, then expand.

Myths about conversational AI in insurance (and the reality)

Most "AI in insurance" discussions fail because of myths. Clearing these up early saves months of wrong architecture decisions.

Myth 1: "Voice bots are just IVR"

Modern voice agents are not "press 1 for claims."

A voice agent can:

- understand natural language,

- handle interruptions,

- call backend tools,

- and hand off with context.

IVR is menu navigation. Voice agents are conversational orchestration.

Myth 2: "AI can fully replace licensed agents"

Insurance has judgment calls, regulated advice boundaries, and complex disputes. A good deployment automates L1-L2 volume and supports licensed humans.

In practice, the best model is:

- voice AI handles intake + status + scheduling,

- humans handle disputes, denials, suitability edge cases, and complex coverage.

Samwill226 described AI voice assistants as an right hand assistant with "E&O layer of protection" for checking applications, endorsements, and policy gaps (shared experience from a working insurance agent on Reddit).

Myth 3: "Insurance is too regulated for conversational AI"

Regulation is manageable. Missing guardrails is the problem.

Voice AI can improve compliance by enforcing:

- mandatory disclosures every time,

- suitability questions in the right order,

- timestamped logs,

- consistent scripts across partners and intermediaries.

A practical warning from the field: "saying the wrong thing" can create legal exposure, especially when customers ask "am I covered for this?" (Reddit discussion on compliance and liability). So the right design is: automate workflow steps, not coverage adjudication.

How to think about use cases across the insurance journey (map + metrics)

The easiest way to pick use cases is to map the journey and attach metrics to each touchpoint. If you cannot measure it, you cannot defend it.

Journey map: sales -> underwriting -> servicing -> claims -> renewals

Conversational AI fits across the lifecycle, but not evenly.

1) Sales / pre-bind

- lead qualification

- quote Q&A

- schedule agent/broker calls

- disclosures + consent capture

2) Underwriting (light-touch support)

- collect missing details

- explain document requests

- status updates ("what is pending?")

3) Policy servicing

- endorsements (address changes, add/remove drivers)

- COI requests (business insurance)

- coverage questions (without making coverage determinations)

4) Claims

- FNOL intake and triage

- claim status and next steps

- document/photo checklist

- proactive updates

5) Renewals

- renewal reminders

- explain premium changes

- upsell riders where appropriate

- payment links and follow-ups

Intermediaries and actors you must plan for:

- Insurer (carrier systems, compliance requirements)

- Agent/Broker (distribution, relationship owner)

- TPA (claims admin, health claims workflows)

- Surveyor/Adjuster (field inspections)

- Hospital/Garage (health providers, repair networks)

- Regulator (recording laws, disclosures, audit trails)

Voice AI becomes the orchestrator. It collects info once, routes correctly, and keeps the customer updated.

KPIs that matter (AHT, containment, CSAT, conversion, leakage)

Pick metrics that match the use case. Otherwise, teams optimize the wrong thing.

Core metrics:

- Containment rate: % of interactions fully handled by the AI without a human Best for: claim status, billing, routine policy questions.

- AHT (Average Handle Time): average duration of handled interactions Best for: servicing flows, status calls, agent-assist.

- CSAT / NPS: customer satisfaction and loyalty signals Best for: claims, renewals, complaint handling.

- Conversion rate / lead-to-appointment rate Best for: sales qualification, renewal outreach.

- Leakage reduction (money lost due to process gaps) Best for: claims follow-ups, missing documents, reinstatement delays.

Contact center KPIs matter too, because insurance calls are time-sensitive. Brightmetrics highlights KPIs like Average Speed of Answer (ASA) and Call Abandonment Rate as critical in insurance because long waits during claims increase stress and reduce confidence (Brightmetrics). Voice AI can reduce queue pressure by absorbing predictable call types.

When voice vs chat works best (channel decision rules)

Channel choice is a product decision.

Voice works best when:

- the user is stressed (claims, hospitalizations)

- the conversation has many "what if" branches

- identity needs to be verified quickly

- you need to guide someone step-by-step

Chat works best when:

- the user needs a link or a PDF

- the task is short (ID card, address update confirmation)

- the user is in a quiet, text-friendly moment

Hybrid is best when:

- voice collects context and confirms intent,

- chat (SMS/WhatsApp) sends payment links, doc checklists, claim IDs, and appointment confirmations.

Hybrid also reduces repetition: the same call summary can be reused across channels, which addresses the "repeat information" frustration described in the 15,000-interaction research (IJFMR, 2024).

Glossary (key terms)

- FNOL (First Notice of Loss): The first report that a loss event happened (accident, theft, hospitalization, fire). It usually triggers claim creation.

- Containment rate: The percent of conversations completed by AI without transferring to a human.

- AHT (Average Handle Time): Average time spent per interaction (talk time + hold + wrap-up).

- TPA (Third-Party Administrator): A partner that administers claims or benefits on behalf of the insurer.

- Endorsements: Changes to a policy after issuance (add driver, address change, coverage changes).

Top conversational AI use cases in insurance (with flows, integrations, handoff, metrics)

Strong use cases have three traits: high volume, clear scope, and measurable outcomes. Below are the top ones that show ROI fastest.

Claims: FNOL intake and triage (auto/home/health) + claim status

Claims is where insurance becomes real. It is also where stress is highest and time-to-response builds trust.

Flow 1: FNOL intake + triage (sample steps)

A practical FNOL conversation flow looks like this:

- Empathy + calm opening "I'm sorry this happened. Are you safe right now?"

- Safety checks (especially for auto/health) If injury risk: escalate.

- Identity and policy lookup Phone + DOB + policy number or member ID (depending on line)

- Incident details (structured)

1. date/time

2. location

3. what happened (short narrative + clarifying questions)

4. other parties involved

5. police report (if applicable)

- Coverage guardrail (not adjudication) The agent should not say "covered/not covered" as a final decision. It can say: "Based on your policy type, I can start the claim and a licensed adjuster will confirm coverage."

- Claim creation in the claims/TPA system Generate claim ID.

- Checklist and next steps photos, documents, repair estimates, provider details.

- Follow-ups send claim ID + checklist via SMS/WhatsApp/email schedule adjuster/TPA callback.

Flow 2: Claim status checks (paired flow)

Status calls are high volume and repetitive. Typical steps:

- verify identity

- ask for claim ID or policy + incident date

- fetch current status from claims/TPA

- explain next action needed (if any)

- offer to send link/checklist via SMS

Required integrations

To make this real (not a demo), FNOL + status needs:

- Telephony / SIP

- Claims system or TPA platform

- Policy admin (for lookup and coverage context)

- CRM (case notes, ownership, follow-up tasks)

- SMS/WhatsApp + email (claim ID, doc list, links)

- Analytics / logging

Handoff rules (do not improvise these)

Hard handoff triggers that I recommend for insurance:

- low confidence intent or entity extraction

- injury, death, or active safety risk

- coverage dispute language ("you people never pay...")

- denial threats / complaint escalation

- fraud-like signals (do not accuse; escalate)

Metrics to track

- containment rate (status calls especially)

- AHT (for escalated calls and blended queues)

- claim cycle time (FNOL-to-settlement is the north star)

- recontact rate (repeat calls within 7 days)

Policy servicing: endorsements, COI requests, add/remove drivers, address changes

Policy servicing is where automation saves the most agent time. It is also where errors create real downstream cost.

Servicing voice flow (example: add/remove driver)

Typical steps:

- verify identity

- ask what change is needed

- collect required fields (driver name, DOB, license state)

- call rating engine for premium impact

- explain change in plain language

- confirm consent

- generate endorsement documents and send e-sign

- update CRM notes and close the service task

Voice works well here because customers ask "what if" questions mid-way. "Will my premium go up?" "What if they drive only sometimes?" A good voice agent answers with guardrails and clear next steps.

Integrations

- policy admin system (read/write endorsements)

- rating engine (premium impact)

- document generation (endorsement forms)

- e-sign provider (consent)

- CRM

Metrics

- time-to-complete endorsements

- error rate (missing fields, wrong driver details)

- agent workload reduction (hours saved)

Experience shared by AcadecCoach “my family's life insurance company uses virtual assistants for appointment setting and marketing support, which removes admin friction for the human team. The same admin offload pattern applies to servicing calls too”.

Billing and payments: due dates, autopay, reinstatement, payment links

Billing calls are repetitive, high-volume, and perfect for containment. They also benefit from a hybrid approach: voice + SMS payment link.

Secure billing voice flow

- Verify identity (minimum necessary)

- Provide due date and amount (limit sensitive details)

- Offer autopay setup (if allowed)

- For payment: send secure link via SMS/WhatsApp

- Confirm payment completion status (via webhook)

- Update billing system + CRM note

Integrations

- Billing system

- Payment gateway

- SMS/WhatsApp provider

- CRM

Metrics

- Containment rate

- Delinquency reduction

- Payment completion rate

- Reinstatement turnaround time

Sales: lead qualification, quote Q&A, and agent/broker handoff

Insurance sales are often about speed-to-lead and clean handoff. Voice agents can qualify, answer basic plan questions, then route.

Voice sales flow (inbound or outbound callback)

- Confirm interest and consent to continue

- Collect basic context (household, vehicle, business type)

- Qualify (timeline, needs, budget range)

- Answer common questions (deductibles, networks, limits)

- Book appointment with agent/broker

- Send calendar invite + doc checklist via SMS/email

- Log everything in CRM

One team using AI for qualification/appointment setting described calling leads within milliseconds of registering, and running multi-channel outreach (text + call + email) so no lead is missed (experience shared by Apprehensive-Fly-954). That speed-to-lead advantage is real in crowded markets.

Integrations

- CRM (Salesforce/HubSpot)

- Quoting engine

- Calendar scheduling

- Compliance recording

- SMS/email

Metrics

- Lead-to-appointment rate

- Contact rate

- Conversion rate

- Drop-off reasons (objections, timing, price)

Two detailed voice-bot examples (end-to-end playbooks)

These examples are meant to be copyable playbooks. They include integrations, handoffs, and what to log.

Example 1: Outbound renewal + upsell voice agent (with payment link)

Renewals are predictable and high leverage. A voice agent can remind, explain changes, and collect intent fast.

End-to-end flow

- Dial + permission check "Is now a good time to talk about your upcoming renewal?"

- Reminder "Your policy renews on [date]."

- Explain premium change (plain language) Keep it simple: "Your premium changed mainly because of [reason categories]."

- Find coverage gaps (guided questions)

1. New drivers?

2. Address change?

3. New valuables?

4. Business usage?

- Suggest add-ons / riders (only within approved rules) Example: umbrella, rental coverage, roadside, critical illness rider.

- Confirm interest and consent "Do you want me to send a secure link to complete payment?"

- Send payment link via SMS/WhatsApp Track link click + completion via webhook.

- Update CRM + policy system tags renewed / at-risk objections follow-up date

- Schedule follow-up If unsure, book a call with an agent.

Handoff triggers (renewals)

- Pricing objections that require negotiation or detailed explanation

- Complex coverage comparisons across carriers/providers

- Regulator-required disclosures that must be acknowledged live

- Customer asks "am I definitely covered for X?" (escalate)

Integrations

- Telephony / SIP

- CRM (Salesforce/HubSpot)

- WhatsApp/SMS

- Payment gateway

- Calendar

- Quoting engine / rating

Example 2: Inbound FNOL voice agent (empathetic, 24/7) + proactive updates

FNOL is the best voice-native use case. The goal is speed, calm, and structured data capture.

Script outline (high level)

- Calm opening "I'm here to help. Are you safe right now?"

- Safety decision If unsafe: advise emergency services and escalate.

- Identity verification Confirm policy/member details.

- Incident facts (structured + narrative) Ask for a short description, then fill gaps with targeted questions.

- Set expectations "I will create the claim now and send you a checklist."

- Create claim in claims/TPA system Generate claim ID.

- Send claim ID and checklist SMS/WhatsApp + email.

- Schedule next step Adjuster callback, repair shop, nurse line, or TPA follow-up.

- Proactive updates Trigger outbound updates on events:

1. claim created

2. document received

3. adjuster assigned

4. additional info needed

Integrations

- Telephony

- Claims/TPA

- CRM

- WhatsApp/SMS

- Analytics and logs

This is where "collect once, reuse everywhere" matters. It reduces cross-channel repetition, which is a known churn driver (IJFMR, 2024).

Sample conversation snippets (plain language for exclusions and deductibles)

Short, human-sounding scripts reduce confusion. These examples avoid overpromising.

- Deductible "Your deductible is the amount you pay first. If repairs cost $2,000 and your deductible is $500, the claim pays the remaining $1,500, subject to review."

- Sub-limit "This part of the policy has its own cap. That means even if your total coverage is higher, this item type is limited to a smaller maximum."

- Waiting period (health/life riders) "This benefit starts after a waiting period. So if the event happens before that window ends, it may not be eligible."

- Exclusion (careful wording) "Some situations are excluded under many policies. I can start the claim and collect details, and a licensed adjuster will confirm coverage after review."

- "What if" edge case Customer: "What if the car was used for delivery that day?" Agent: "Thanks for mentioning that. Usage can affect how the claim is handled. Let me capture that detail and connect you with an adjuster so you get the correct guidance."

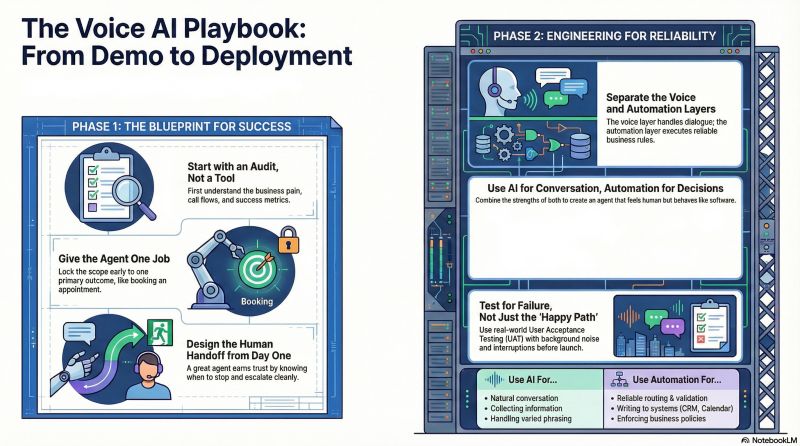

Implementation guide: building an open source voice AI agent (Dograh + LiveKit/ Pipecat/ Vocode)

Open source matters in insurance because data, governance, and lock-in risk are real. You want control over hosting, keys, logs, and guardrails. This is where Dograh fits: fast workflow building, with an open-source mindset.

Reference architecture (telephony -> STT -> LLM -> tools -> TTS)

A voice agent is a streaming pipeline, not a single model.

A simple architecture in words:

- Telephony/SIP provider receives the call

- Audio streams into a real-time media layer like LiveKit (low latency WebRTC, recording, SIP trunking)

- STT (speech-to-text) converts the caller's audio to text

- LLM orchestration decides what to do next (ask a question, confirm details, call a tool, or escalate)

- Tool calls hit your real systems (claims/TPA, policy admin, billing, CRM)

- TTS (text-to-speech) speaks the response back to the caller

- Logs + analytics capture outcomes for QA and compliance

For pipeline orchestration, open source projects like Pipecat are designed for real-time streaming conversations with interruptions and turn-taking. For programmable voice agents, Vocode is a common open-source SDK for inbound/outbound calling and call controls.

Dograh sits at the workflow layer: it helps you define conversation steps, tool calls, and handoffs using a visual builder and plain-English edits. It also supports bring-your-own keys and self-host options, which many insurance teams need.

What is a tool-calling voice agent (vs a script-only voice bot)?

A tool-calling voice agent is a voice AI that can take actions in real systems. It does not just speak. It reads and writes data through APIs.

In insurance, tool calling is the difference between:

- "I can help you check your claim" (script-only), and

- actually fetching the claim status from the TPA and sending the checklist (tool-calling).

Tool calling also improves reliability. The agent can confirm facts from systems instead of guessing. That matters in a regulated industry where making something up creates risk.

A practical design pattern: keep the LLM for conversation and routing, but keep decisions (payment confirmation, claim status, eligibility checks) grounded in tool outputs and hard-coded rules.

Integrations checklist by system (policy admin, claims/TPA, CRM, docs)

Integrations decide whether your voice bot is useful.

Policy admin

- Read: policy lookup, coverage context, insured details

- Write: endorsements, address changes, notes

- Triggers: policy updated, renewal approaching

Claims system / TPA

- Read: claim status, adjuster assignment, missing documents

- Write: create claim (FNOL), upload metadata, add notes

- Triggers: claim created, doc received, action required

CRM

- Read: customer history, owner agent, previous tickets

- Write: call summary, disposition, follow-up tasks

- Triggers: new lead created, renewal risk, complaint flags

Docs + messaging

- Doc generation: forms, COI, endorsement PDFs

- Messaging: send claim ID, payment link, checklist

- Triggers: e-sign completed, bounced emails, link clicked

Security basics

- Least-privilege permissions

- Scoped tokens per tool

- Audit logs per write action

Human handoff design (confidence, sentiment, and escape hatch)

Handoff is the safety system. Design it well and you can deploy faster with less risk.

Rules that work in insurance:

Hard confidence thresholds

- If intent confidence < a set threshold, escalate

- If entity extraction fails twice (policy number, DOB), escalate

Escape hatch always available

- "Talk to an agent" must work at every step

- No looping or punishment

Sentiment-based escalation

- Detect distress, anger, panic

- Switch to empathy-first mode, then route to a human

Disputes and denials

- If caller uses denial or dispute language, escalate

- Voice AI should not argue.

Tool failures

- If claims system or billing tool errors, apologize and transfer

- Create a ticket automatically with the error code

How to pass context to humans:

- Short summary

- Extracted fields (structured)

- Tool outputs (claim status, due date)

- Call recording link and transcript

- Recommended next action

How Dograh helps without reading like an ad

Most insurance teams should not buy a platform because it looks polished in a demo. They should buy (or build) based on how quickly they can ship safe flows, connect systems, and fix failures.

Where Dograh helps in this insurance setup:

- Drag-and-drop visual flows for common intents

- Edit workflows in plain English, not only code

- Multi-agent workflows to reduce hallucination and enforce decision trees

- Webhooks for internal APIs and partner systems

- Multilingual voices via your chosen STT/TTS providers

- Analytics for containment, drop-offs, and handoff reasons

- Looptalk, an AI-to-AI testing suite (work-in-progress), to stress test flows before production

If you want to explore Dograh, you can start at Dograh. The ask: beta users, contributors, and blunt feedback.

Risk, security, and compliance (insurance-ready guardrails)

Insurance AI fails when teams treat it like a generic chatbot. You need guardrails that assume regulation, audits, and complaints. This section is about building something you can defend.

PII, consent, and call recording rules (what to capture and why)

PII handling should be designed, not added later.

Recommended controls:

Consent prompt

- "This call may be recorded for quality and compliance."

- Track acknowledgement with timestamp.

Data minimization

- Ask only what you need for the intent.

- Do not collect sensitive info if a payment link will handle it.

Storage and retention

- Define retention policies for recordings and transcripts.

- Store with encryption and role-based access.

Redaction

- Mask sensitive fields in transcripts (DOB, SSN, card-like data).

- Limit transcript access to QA and compliance roles.

Audit trails

- Log tool writes: who/what wrote, when, and why.

- Keep a consistent audit record across intermediaries.

Brightmetrics' KPI guidance also reinforces why queue and abandonment metrics matter in insurance during urgent moments (Brightmetrics). If you reduce waits with voice containment, you reduce customer stress.

Top 5 failure modes and the guardrails that prevent them

Failure modes are predictable. So are the fixes.

A strong principle from real insurance deployments: keep voice automation scoped to status + intake, not adjudication. That reduces E&O exposure while still delivering ROI.

What is regulated scripting in conversational insurance workflows?

Regulated scripting means the assistant follows required language and steps exactly. This includes mandatory disclosures, suitability questions, and consent capture.

In practice:

- Fixed wording for certain disclosures,

- Forced checkpoints (cannot skip),

- Structured logging of when each disclosure was read.

This is useful because insurance often involves intermediaries. A voice AI can enforce consistent wording across agents, brokers, and partners. It also produces audit evidence: timestamps, transcript snippets, and call recording pointers.

A good approach is hybrid: allow natural conversation for non-regulated parts, then switch into "script mode" for regulated steps. That keeps the experience human while keeping compliance tight.

Vapi vs Open Source Voice Agents: Which to Choose?

Discover Vapi vs Open-Source voice agents like Dograh, Pipecat, LiveKit, and Vocode to decide the best option for cost, control, and scale.

Proof it works: rollout numbers + how to measure ROI

ROI is not "AI sounds good." You need containment, time savings, and customer experience gains. Here is a benchmark plus a measurement plan.

Case study: mid-size US health insurer (claims + prior auth support)

This deployment focused on high-volume, emotional, repetitive calls. It combined voice automation with clear handoffs.

Line of business: Employer-sponsored health insurance Call types: claim status, prior-authorization guidance, document follow-ups Voice agent role: empathetic intake + workflow orchestration Containment rate: 65% (status checks + simple guidance) AHT impact: down 38% overall, and down 55% on status-only calls Integrations: telephony, CRM, claims system/TPA, WhatsApp & SMS, calendar scheduling.

Why it worked:

- Status calls are repetitive and tool-driven, so containment is realistic

- Claims-related calls are emotional, so voice reduces friction

- Messaging links handled documents and follow-ups without re-calling

This aligns with broader research that AI is driving efficiency gains in underwriting and claims, while insurers face parallel pressure for ethical governance and transparency (PMC paper citing McKinsey 2022; Eurofi 2024; Li & Guo 2024).

Measurement plan: dashboards, QA sampling, and continuous improvement

Weekly tracking beats quarterly surprises. You want a dashboard that shows operational value and risk.

Track weekly:

- Containment rate by intent (status vs billing vs FNOL)

- Escalation rate and top escalation reasons

- AHT by queue and call type

- CSAT/NPS prompts (where appropriate)

- Conversion outcomes (appointments booked, renewals completed)

- Tool-call success rate (did the agent's tool calls succeed?)

- Recontact rate and churn signals

QA artifacts to store:

- Call summary

- Extracted fields

- Tool outputs

- CRM updates

- Compliance checklist completion

Also track contact center operational KPIs like ASA and abandonment, because they are leading indicators of customer stress in insurance.

Data moat: every call improves objection handling and fraud signals

Every call creates training data for better operations. Not "magic fraud detection," but real process intelligence.

Over time, transcripts help you:

- Build better objection-handling scripts for renewals and sales

- Improve routing rules (status vs dispute vs complaint)

- Detect anomaly patterns (unusual timing, repeated identity failures, conflicting narratives)

Claims automation research reports major efficiency gains when RPA and AI are integrated, including 90% reduction in processing time (72 hours to under 5 minutes), 40-70% cost reductions, and 99% accuracy for standard forms (IJFMR, 2024). Voice agents contribute by capturing clean structured FNOL and triggering the downstream RPA workflow earlier.

Synthflow vs Open Source Voice Agents: Which to Choose ?

Explore Synthflow vs Open-Source voice agents like Dograh, Pipecat, LiveKit, and Vocode to find the best option for cost, control, and scalability.

Start in 30 days: buyer-ready rollout checklist (pilot to production)

A 30-day plan works if you keep scope tight. You are proving value, not boiling the ocean.

Pick a pilot that wins (L1-L2 volume, low risk, clear ROI)

Good pilots are high volume and low decision risk.

Pick 1-2:

- Claim status (fast containment, tool-driven)

- Billing + payment links (high volume, measurable cash impact)

- Renewal reminders (clear conversion metrics)

- Basic FNOL intake (intake + scheduling, not adjudication)

Set success targets up front:

- Containment target by intent

- AHT reduction target

- Abandonment reduction target

- CSAT target for contained flows

- Escalation staffing plan for off-hours

Build + test: scripts, knowledge base, Looptalk stress tests

A build plan that works:

- Define top intents and boundaries ("we do intake and status, not coverage decisions")

- Draft scripts and mandatory disclosures

- Connect tools via webhooks (claims, policy, billing, CRM)

- Create multilingual variants if needed

- Create fallback prompts and escalation rules

- Cun stress tests with personas:

1. angry claimant

2. confused shopper

3. renewal price objection

4. fraud-like inconsistencies (route to human, do not accuse)

Dograh's Looptalk concept is designed for this: AI-to-AI conversations that hit your workflows repeatedly to find loops, tool failures, and unsafe responses before customers do.

What is AI-to-AI voice testing (and why it matters for insurance voice bots)?

AI-to-AI voice testing means you use an AI "caller" to talk to your AI voice agent. You simulate hundreds of scenarios with different personas, accents, speeds, and emotional tones.

This matters in insurance because real calls are messy. People interrupt. They change topics. They are stressed. AI-to-AI testing helps you find:

- Looping prompts,

- Intent confusion,

- Tool failure recovery problems.

It also helps with compliance readiness. You can verify that disclosures are read, logged, and not skipped. For regulated and high-stakes workflows, this kind of stress testing is closer to pre-production safety checks than normal QA.

Go live safely: monitoring, escalation staffing, and iteration loop

Launch with safety rails, not bravado.

A safe go-live approach:

- Soft launch to a subset of call types or hours

- Time-of-day routing (human-heavy during peak, AI-heavy off-hours)

- Monitor:

1. Tool errors

2. Low-confidence spikes

3. Sentiment escalation rates

4. Abandonment trends

- weekly iteration loop:

1. Update prompts

2. Improve tool reliability

3. Tighten handoff rules

4. Retrain intent routing

If you are building this in open source and want to contribute, Dograh is looking for beta users and contributors via Dograh. Feedback that includes call recordings, failure cases, and missing integrations is especially useful.

Key Terms (implementation-focused glossary)

These terms are specific to voice agents and insurance deployments.

- AI-to-AI voice stress testing (Looptalk): Automated testing where AI callers simulate real customer conversations to find loops, unsafe responses, and tool failures before launch.

- Tool-call success rate: The percentage of backend tool/API calls that return valid results within time limits. Often measured as successful tool calls / total tool calls, segmented by tool and intent.

- Regulated scripting (mandatory disclosures + timestamped audit logs): A workflow mode where the agent must read exact required text, ask required questions, and log timestamps so compliance can be proven.

- Streaming voice pipeline (telephony -> STT -> LLM -> tools -> TTS): The real-time architecture that turns audio into text, decides actions, calls systems, and speaks back with low latency.

Prerequisites (what you need before building)

Most failed pilots fail because of missing basics.

You need:

- Top 10 intents by call volume (from your contact center reports)

- Access to at least one system of record (claims/TPA, billing, or policy admin)

- A CRM or ticketing system to store summaries and follow-ups

- Defined compliance scripts and recording consent rules

- Escalation staffing plan (especially nights/weekends)

- Agreement on scope boundaries (what the AI will not do)

Conclusion: voice is the best "front door" for insurance AI

Insurance is nuanced, emotional, crowded, and regulated. That combination is why voice agents are winning when chat-only automation fails.

My bias: if you are an insurer with any meaningful call volume, you should deploy voice for claim status and billing first. Those calls are predictable, tool-driven, and the ROI is hard to argue with. Save the messy coverage conversations for licensed humans and use the AI to do intake, status, scheduling, and compliance-heavy scripting.

If you want to build with an open-source mindset, combine:

- a workflow layer (Dograh),

- real-time media (LiveKit),

- a streaming pipeline (Pipecat),

- and programmable calling (Vocode), then measure containment, AHT, and trust signals during claims.

Related Blog

- Discover the Self-Hosted Voice Agents vs Vapi : Real Cost Analysis

- A Practical Cost Comparison Self-Hosted Voice Agents vs Bland: Real Cost Analysis (100k+ Minute TCO)

- A Practical Cost Comparison Self-Hosted Voice Agents vs Retell: Real Cost Analysis (TCO Tables + $/Min).

- Explore Voice AI for Law Firms: Why We Chose Quality Over Latency By Alejo Pijuan (Co-Founder & CEO @ Amplify Voice AI, AI Ethics Thought Leader, Expert Data Scientist, Previously senior data scientist at Nike.)

- See how 24/7 Virtual Receptionist Helps Small Firms Win More Clients by boosting responsiveness and improving customer engagement.

- Learn how From Copilots to Autopilots The Quiet Shift Toward AI Co-Workers By Prabakaran Murugaiah (Building AI Coworkers for Entreprises, Government and regulated industries.)

- Check out "An Year of Building Agents: My Workflow, AI Limits, Gaps In Voice AI and Self hosting" By Stephanie Hiewobea-Nyarko (AI Product Manager (Telus AI Factory), AI Coach, Educator and AI Consultancy)

FAQ's

1. What is a common use of AI in the insurance industry?

A common (and high-ROI) use of conversational ai in insurance is deploying voice agents to handle high-volume L1–L2 calls across service, sales, and claims.

2. Can use conversational AI to answer basic questions for consumers?

Yes, conversational ai in insurance can answer basic (and many advanced) consumer questions, as long as it runs inside strict guardrails. A Dograh voice bot can handle common requests efficiently.

3. How to use AI in insurance?

To use AI effectively in insurance, start with voice workflows that remove friction for customers and workload for teams, then expand into orchestration.

4. Why is voice-based conversational AI better than chatbots for insurance?

Voice-based conversational ai in insurance often outperforms basic chatbots because insurance conversations are rarely linear. Customers interrupt, ask “what if” questions, and need plain-English explanations of exclusions, deductibles, riders, and sub-limits, especially during stressful claim moments.

5. What guardrails should you add to a conversational AI voice agent in insurance?

Insurance is regulated and full of edge cases, so guardrails are mandatory for safe ai powered insurance experiences. Start with a clear scope: automate intake, status, and education, but avoid adjudication (e.g., denying claims) unless tightly controlled. Use confidence thresholds so uncertain answers trigger handoff, and provide “talk to an agent” at every step.

Was this article helpful?